IMF Tokenomics

The IMF will have 2 tokens:

- The equity and utility token $IMF

- The meme-backed unstablecoin $MONEY

$IMF

IMF is the native equity and utility token of the protocol

Total Supply: 69,000,000

Token Allocation:

- 6% - Team

- 10% - Public Sale

- 15% - SK allocation

- 69% - Emissions to bootstrap protocol

$IMF Emissions

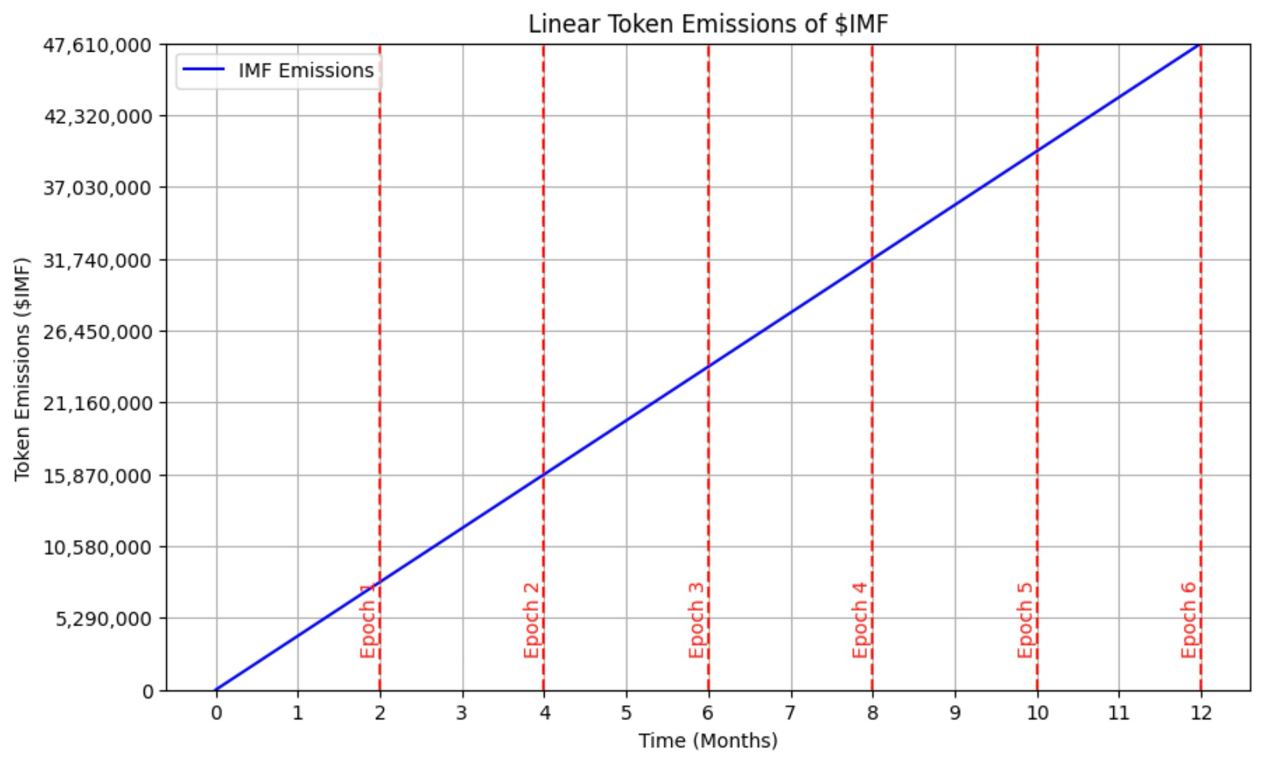

69% of the total supply (47,610,000 IMF) will be distributed to IMF users through emissions.

Emission Schedule: Linear distribution over 12 months.

Seasons: The 12-month period will be divided into six 2-month epochs, or seasons.

Distribution Criteria: Each season will have specific distribution criteria, which will be announced before the season starts.

Season Breakdown:

- Season 1: 50:50 distribution for Borrowers and Liquidity Providers (LPs).

- Seasons 2-6: To be announced (TBA).

The distribution criteria will be adjusted based on the activities we aim to incentivize most during each season. For Season 1, we will equally incentivize borrowing and providing liquidity. Future criteria will be communicated before each new season begins.

Team

Bros we literally only took 1% each between the 6 of us

Please pump $IMF so we actually get paid from this

ty

SK Allocation

SK allocation is 15% of supply

This portion of supply should be regarded as what would normally be “foundation” funds, for the further development and support of the protocol

More details to come on this soon.

Flywheels and Airdrops

Early borrowers of $MONEY will get $IMF emissions based on % of TVL borrowed.

Early LPs will get $IMF emissions based on % of total in range liquidity provided.

Early SKs will get given IMF based on being a SK and contributing to the IMF.

sbIMF: Slow Burn IMF

This is staked $IMF with no lock periods, however there is a burn rate for depositors based on amount staked, effectively a negative interest rate. This means you will slowly lose your balance of sbIMF as time goes on

So why TF would you do this?....

sbIMF holders get 100% of protocol revenue.

Burn rate = total_staked / total_supply.

Market will find an equilibrium between burn rate and reward rate.

sbIMF removes $IMF from circulating supply, and provides an autonomous mechanic for a buy back and burn DCA.

$MONEY

$MONEY is the native “unstablecoin” of the IMF.

$MONEY gets minted when a user borrows against deposited collateral

$MONEY is a fully decentralized permissionless softpegged stablecoin backed by memes

Total Supply: dynamic supply based on how much is borrowed + interest accrued

SoftPeg Mechanisms:

$MONEY targets a price of $6.90… because of inflation bro.. through 2 main softpeg mechanisms

- Interest Rate Model

- CDP Pricing Model

Interest Rate Model

$MONEY interest rate is a dynamic curve.

If the price is exactly $6.90, then the borrow interest rate is 6.9%, this is the "kink" in the curve.

As the price of $MONEY depegs down form $6.90, the interest rate increases exponentially. If the price of $MONEY depegs above $6.90, the interest rate decreases.

If $MONEY trades below $6.90, it means the market is bullish memes so interest rate goes up to increase the cost of borrowing and incentivize repaying debts. If $MONEY trades above $6.90, the interest rate goes down to decrease the cost of borrowing and incentivize taking debt.

CDP Pricing Model

$MONEY is hard pegged at $6.90 in the CDP markets.

This means that when a user deposits a meme and borrows $MONEY, they borrow it at a protocol value of $6.90, regardless of its trading price on secondary markets. Consequently, when a user wants to repay their debt, they repay it at a rate of $6.90 per $MONEY.

This creates an arbitrage that helps maintain the peg of $MONEY.

If $MONEY is trading below $6.90 on secondary markets, users are incentivized to buy $MONEY from these pools and repay their debt, as they are buying at a discount and repaying at $6.90.

Conversely, if $MONEY is trading above $6.90 on secondary markets, users are incentivized to deposit memes, borrow $MONEY at $6.90, and sell it at the higher market price.

This buy/sell pressure arbitrage helps move liquidity to keep $MONEY soft pegged at $6.90.